Full-Time Struggle and Two-Job Juggle: A Tax Holiday for Canadians to Fight Rising Costs

Economic Note proposing a resetting of the marginal tax rate to zero on secondary jobs for full-time workers

Related Content

Related Content

This Economic Note was prepared by Jason Dean, Associate Researcher at the MEI and Assistant Professor of Economics at King’s University College at Western Ontario, in collaboration with Renaud Brossard, Vice President, Communications at the MEI. The MEI’s Taxation Series aims to shine a light on the fiscal policies of governments and to study their effect on economic growth and the standard of living of citizens.

Many Canadians today are facing an uphill battle to make ends meet and maintain some sense of financial normalcy. Soaring prices have led to a nearly 16% reduction in overall spending power since 2020.(1) Without comparable income increases, some two-thirds of Canadians worry about being able to adequately manage their daily expenses.(2) On top of this, 22-year-high interest rates mean many households are bracing for a daunting hike in their monthly mortgage payments, forcing some of them to consider the painful reality of selling their homes.(3)

Driven by necessity, a lot of Canadians find themselves compelled to explore alternative ways to earn extra money. Many have either taken on a side job or are considering doing so. In a disheartening twist, however, these extra earnings, when combined with their main-job earnings, are heavily taxed, worsening their struggle and underscoring the need for supportive tax relief to reward their efforts, not penalize them.

Second Jobs Increasingly Attractive, but Heavily Taxed

The latest figures from Statistics Canada show that about one million workers are juggling multiple jobs.(4) Moreover, more than one-in-three multiple job holders (34.9%) say that extra work is needed to cover basic living costs. This is a notable surge from the one-in-five reported just before the pandemic. Also, survey data collected as part of the BDO Affordability Index hints at a continuing upward trend, with around a third of their respondents pondering getting a side job.(5)

The Labour Force Survey presents annual figures on the incidence of full-time workers who have taken on a second job. It is these workers who presumably are willing to work long hours, as they require additional income to manage pressing financial obligations such as family responsibilities, mortgages, rent, other debts, or saving up for a home. A noticeable upward trend is evident, from 3.1% of full-time workers in 2020 to 3.9% in 2022, and then leveling off at 4.0% in 2023 (to November 30).(6)

The latest figures from Statistics Canada show that about one million workers are juggling multiple jobs.

Whether this is a genuine plateau or a temporary lull is an open question, pending December’s figures and considering the likely underreporting of informal secondary employment. As well, the recent beginnings of an economic downturn(7) could mean fewer part-time job openings. But certainly, secondary employment might be even more popular if not for the steep toll imposed on those choosing this path.

It seems likely that the choice to work a side job is driven more by financial need than a desire to splurge on luxuries. In any case, such a decision involves hefty trade-offs, including added stress, a skewed work-life balance, and potentially burnout. It is somewhat odd, then, that our tax system, meant to enhance fairness through tax redistribution, extends its progressively higher rates even to earnings made in a second job. This thwarts the efforts of these workers to improve their financial situation by undercutting the modest earnings they toiled for and depend on.

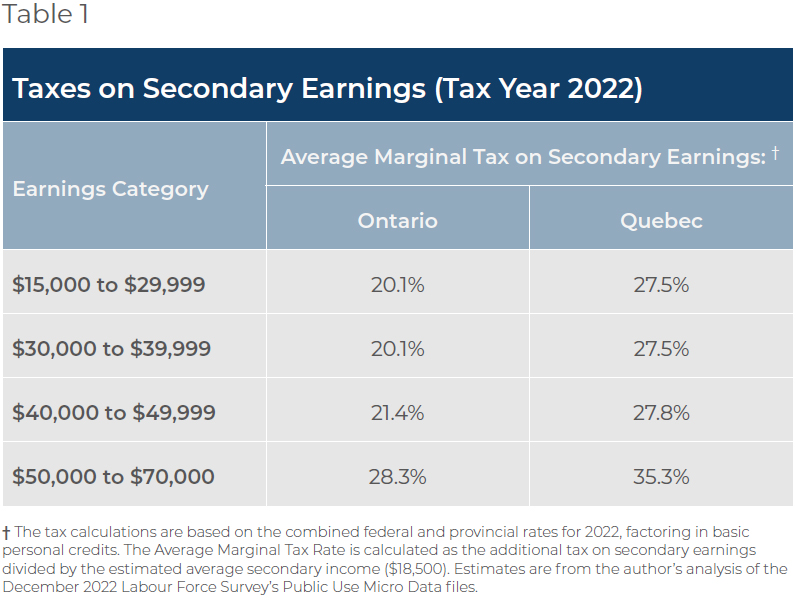

Table 1 shows the average marginal tax rates on side incomes from paid work, exposing the significant tax burden on additional earnings in Ontario and Quebec. Full-time workers in Ontario earning under $50,000 at their main job lose over 20 cents of every hard-earned dollar from their second job to taxes. In the next bracket, up to $70,000, this burden rises to over 28 cents. In Quebec, the figures show an even higher burden, about 7.5 percentage points more in all brackets.

The calculations are based on the 2022 tax year, when the latest data were available. It must be noted though that, as part of its 2023 budget, the government of Quebec lowered its first two income tax rates by one percentage point each. This reduces the gap between it and Ontario to 6.5 percentage points.

Note that even at the higher bracket, these are not the wealthy one percent, but rather middle-income workers who are far from immune to the soaring cost of living. It is painfully obvious that those working multiple jobs are heavily penalized for their perseverance. Clearly, there is a need for tax policies that help, rather than hinder, those simply seeking some financial stability.

A Tax Holiday for Second Jobs to Help the Hard-Working

There is an inherent unfairness to the tax burden borne by those with secondary employment, compared to workers who can obtain overtime pay at their main job or benefit from tax breaks for their extra hours. Roughly 11% of workers have access to paid overtime,(8) while a growing number—28%, up from 13% in 2022—are actively providing their services in the expanding gig economy.(9)

Any additional marginal taxes incurred by the first group are more than offset by earning 1.5 times their normal pay for overtime hours. As for the second group, they enjoy the perks of being deemed independent contractors, which means they can deduct all work-related expenses—from vehicle and home office costs to meals and smartphone bills, and even mortgage interest.

There is an inherent unfairness to the tax burden borne by those with secondary employment.

The need to level the playing field is evident, as there is no similar tax alleviation for second-job employees in paid work. A resetting of the marginal tax rate on secondary jobs would be a pragmatic and sensible solution to offer much-needed financial relief and not penalize those who need to work more. At the same time, the ability to pocket a bigger share of any extra earnings could entice more people to work (or work more) and ease the persistent labour shortage.

To be specific, the rate applied to secondary income should start at the bottom rung of the progressive tax ladder, as if these were the first earnings of the year. Ideally, eligibility criteria should target multiple job holders in the low- to middle-income range, engaged in paid employment, with a full-time main job and at least six months of steady work in that role. This will make sure the policy zeros in on those genuinely in need, primarily those balancing family and personal financial commitments all while coping with ballooning living expenses and slow-to-rise wages.

The bottom half of earners are more likely to hold a second job anyway, signifying a greater need for additional income.(10) Thus, the natural threshold for the policy is this group’s average labour market earnings. Multiple part-time job holders are not targeted as their lower incomes are already taxed less, but also because almost 60% are either self-employed or not permanently attached to the labour market—young, elderly, students, or with other non-economic reasons—with about 40% of this subset reporting part-time as a personal preference.(11)

Implementing this proposed policy would not entail any heavy administrative burden. An infrastructure is already in place to modify the amount of taxes withheld from their paycheques using the TD1 form and its provincial variants. An additional section with a simple checkbox could be added to the forms so workers with a second job could claim the tax holiday. To validate claims, taxpayers could provide recent paystubs or a T4 slip to verify their full-time status. This means that the reward for their extra work would be reflected on their next paycheque.

This is important, as it aligns with a general economic principle by which the reward used to incentivize a particular behaviour must be closely timed. Thus, the potential policy effect of motivating increased workforce participation is enhanced, and with fair payment, in line with how overtime and contract workers are compensated.

Estimated Impact on Tax Revenue

What is the impact of this policy on government revenues? This can be assessed by estimating how much tax revenue would be lost when the reset policy is applied to secondary earnings for eligible full-time workers.

The method for assessing the revenue impact is straightforward: The total revenue loss (per bracket) is equal to the average difference between taxes payable with and without the reset, multiplied by the number of multiple job holders in each bracket. Totals for each bracket are then summed.

Greater economic activity and elevated sales tax revenues would mitigate the policy’s reduction in tax revenues.

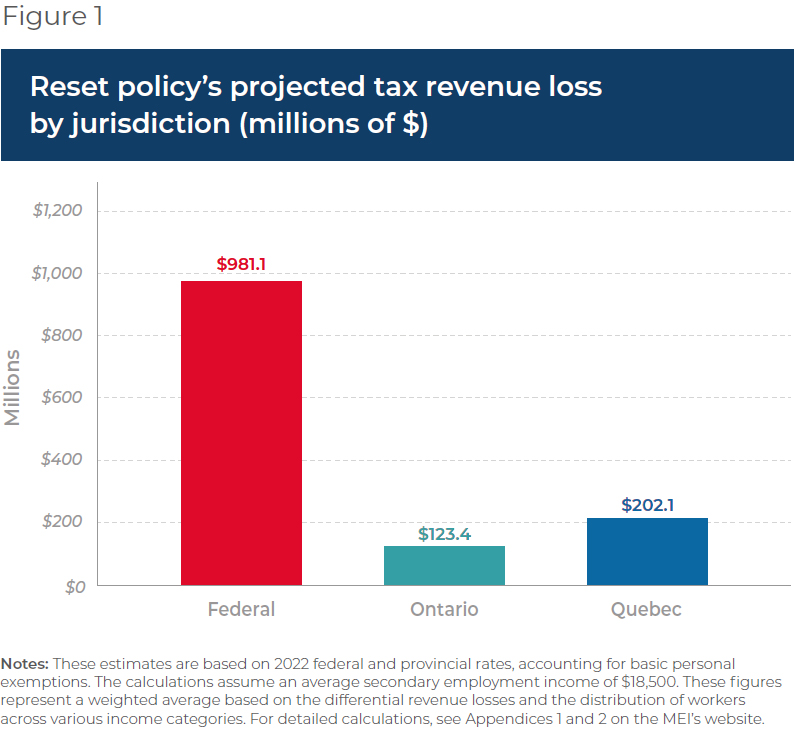

Figure 1 shows the revenue implications for the federal government. It would be commendable if provincial governments also provided similar tax relief, and for illustration purposes, the figure shows the potential tax revenue impact in the two largest provinces, Ontario and Quebec.

The calculated figures for taxes payable are based on the 2022 federal and provincial rates, and account for the basic personal exemption amounts in the respective jurisdictions, with an estimate of $18,500 for secondary earnings. All estimates were obtained from an analysis of the December 2022 Labour Force Survey.(12) (For detailed calculations, see Appendices 1 and 2.) The federal government would forego $981.1 million in tax revenue, while the fiscal shortfall for Ontario and Quebec would be $123.4 million and $202.1 million, respectively.

It is important to consider any offsetting effects, and to also put the estimated impact in perspective. To the extent that this tax holiday encourages more people to join the workforce (or to work more), the greater economic activity and elevated sales tax revenues would mitigate the policy’s reduction in tax revenues. Moreover, in contrast with the federal government’s recent quick fix payout schemes—such as the doubling of the GST credit for six months and the grocery rebate—this policy offers a more long-term solution. Those other policies, each with outlays of around $2.5 billion,(13) dwarf the anticipated revenue drop from the proposed reset policy, and their reach is moreover limited to low-income Canadians, neglecting the struggling middle class. Another point to consider is that the reset policy’s lower tax burden might make people more likely to report their side-job earnings, leading to improved tax compliance and more accurate labour market statistics.

Conclusion

Canadians’ economic strain is both painful and real. In their bid to regain financial stability, many are contemplating or have felt compelled to take on side jobs, only to see their perseverance unfairly punished by steep marginal taxes. Real solutions are needed, not quick-fix payouts that do little to alleviate hardship or address employers’ challenges finding workers.

A marginal reset of the tax rate on second jobs promises broader and more lasting relief, and can play a role in addressing our acute labour shortages. It also levels the playing field by reducing the tax burden for paid full-time workers with second jobs to bring it in line with the benefits already enjoyed by those eligible for paid overtime and the deductions allowed for the self-employed. This is a tangible, easy-to-implement solution that acknowledges and rewards Canadians for their economic resilience.

References

- Author’s calculations. Bank of Canada, Consumer price index, consulted December 12, 2023.

- H&R Block Canada Inc., “Canadians Rein in Spending and Seek Second Incomes; 69% Worry About Making Ends Meet Despite Having a Decent Salary; 58% Worry About Paying Down Debt,” Press release, March 9, 2023; Statistics Canada, “Labour Force Survey, October 2023,” November 3, 2023.

- Nivedita Balu and Fergal Smith, “Little relief for indebted Canadian homeowners as mortgage rates seen higher for longer,” Reuters, August 23, 2023.

- Statistics Canada, “Labour Force Survey, August 2023,” September 8, 2023.

- BDO Canada LLC, “Canadians cut back on expenses, seek better budgeting habits, and consider taking on extra work amid inflation pressures,” Press release, May 25, 2023.

- Author’s calculations. Statistics Canada, Table 14-10-0048-01: Multiple jobholders by usual hours worked at all jobs, monthly, unadjusted for seasonality (x 1,000), December 1st, 2023.

- Ismail Shakil and Steve Scherer, “Canada’s economy unexpectedly shrinks; central bank likely to hold rates,” Reuters, September 1st, 2023.

- Author’s calculations. Derived from the October 2023 Labour Force Survey’s Public Use Micro Data files. The figure represents the percentage of a restricted sample of full-time, non-student, paid employees aged over 25 years reporting any paid overtime hours in the reference week.

- H&R Block Canada, “Nearly half (44%) of Canadian gig workers are willing to risk not declaring income in the battle against cost-of-living increases; 51% say their primary employer is unaware of their side hustle,” Press release, March 2, 2023.

- Meghan Fulford and Martha Patterson, “Multiple jobholders in Canada,” Statistics Canada, October 28, 2019, p. 6.

- Author’s calculations. Derived from the October 2023 Labour Force Survey’s Public Use Micro Data files. The figure illustrates the distribution of reasons for part-time work among Canadians who hold multiple part-time jobs.

- Statistics Canada, Labour Force Survey’s Public Use Micro Data Files, Table 14-10-0287-01, December 2022, consulted December 9, 2023.

- Department of Finance Canada, “Making Life More Affordable: Doubling the Goods and Services Tax Credit for Six Months,” September 29, 2022; Environment and Climate Change Canada, “Minister Steven Guilbeault highlights budget investments to make life more affordable with new Grocery Rebate,” Press release, March 30, 2023.