5-minute read

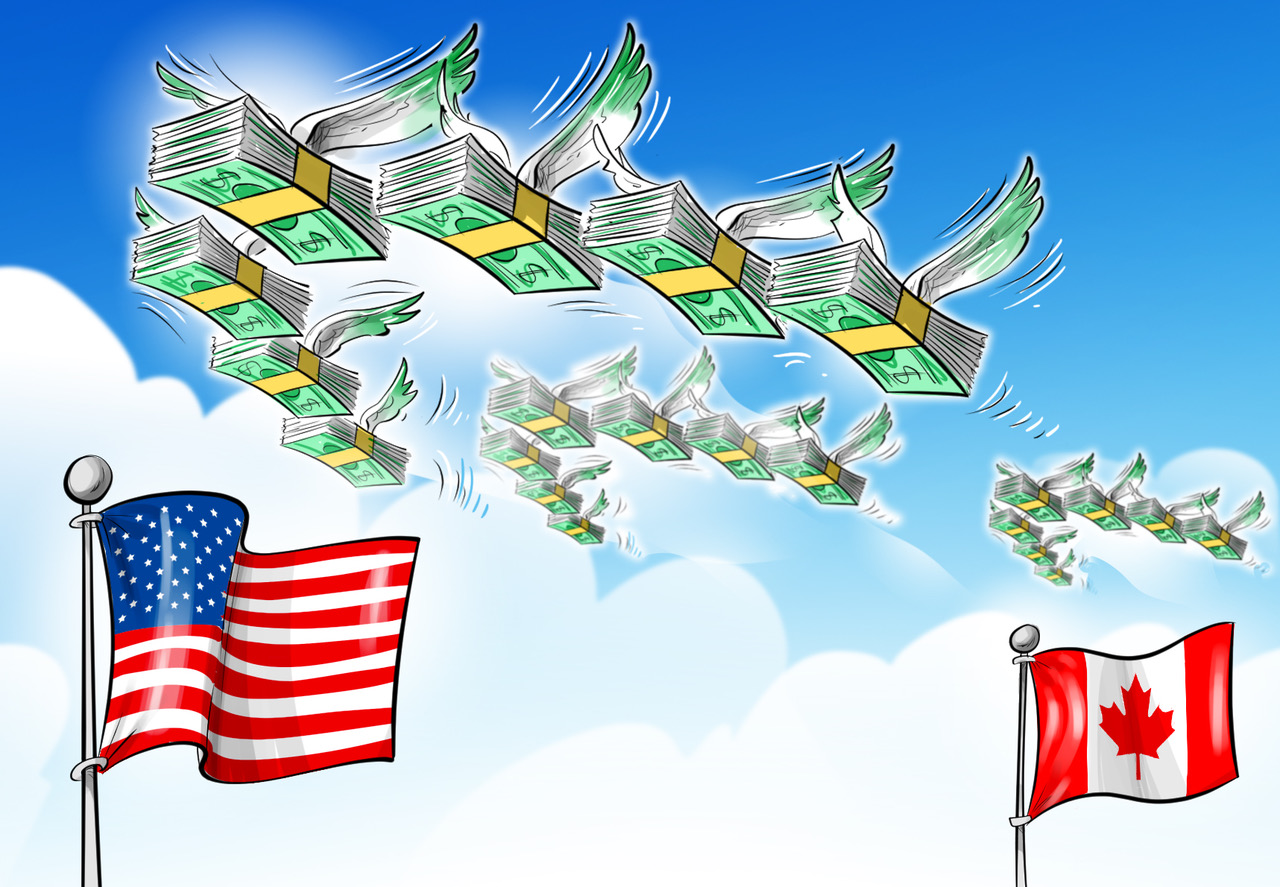

Don’t worry, America: Canada’s corporate tax cuts did not deepen its deficit

The impact of the bipartisan effort to reduce Canada’s corporate tax rate.

11-minute read

Canada’s Corporate Tax Cut Success: A Lesson for Americans

In December 2017, President Donald Trump cut corporate tax rates from 35% to 21%, effective immediately. While certain critics quickly lamented this policy decision, the President is currently mulling a second round of tax cuts. In this context, the Canadian experience with corporate tax reduction provides a useful comparison.

4-minute read

Canadian competitiveness has a lot of catching up to do

Canada is stagnating or even losing ground in terms of competitiveness.

4-minute read

Le Canada stagne, il est impératif d’agir

Canada is stagnating or even losing ground in terms of competitiveness.

4-minute read

Où est le débat sur la compétitivité canadienne?

Canada is much less competitive than it was in the past.

4-minute read

How high taxes and fees punish air travellers

High Taxes and Fees Penalize Travellers.

MEI – High Taxes and Fees Penalize Travellers – Alexandre Moreau

June 21, 2018 | 9 min. 12 sec. | Afternoons with Rob Breakenridge (770 CHQR) Interview with Alexandre Moreau, Public Policy Analyst […]

12-minute read

Air Transport: High Taxes and Fees Penalize Travellers

The Canadian air transport sector has experienced significant expansion in recent years. Nonetheless, a multitude of taxes and fees are restricting its potential for growth. Given that favourable conditions are dissipating, especially when it comes to low fuel prices, what can governments do to reduce the fees imposed on transporters, and ultimately on travellers?

4-minute read

Transport aérien: les frais pénalisent les voyageurs

High Taxes and Fees Penalize Travellers.

14-minute read

The Carbon Market: Chasing Away Jobs and Capital without Reducing GHGs

A carbon market, like a carbon tax, aims to modify behaviours in order to reduce GHG emissions by setting a price for them. Although such mechanisms are regularly mentioned in the news, their economic consequences are less often discussed, to say nothing of their effectiveness. Does imposing a price on carbon always reduce emissions, or does it instead displace them, along with the accompanying economic activity? In the two scenarios examined here, the effect on GHG emissions would be negligible, but the economic impact would be significant.