4-minute read

Canadian businesses need a tax cut

The benefits of a tax cut for Canadian businesses and workers.

14-minute read

What Are the Benefits of Economic Freedom?

A useful and intuitive definition of “economic freedom” is the freedom (absence of coercion) to buy from, or sell to, a willing counterparty. A society based on economic freedom is a free-market society. But is economic freedom economically beneficial? Is it all about money? Is it moral? Aren’t there many exceptions where government intervention is warranted? This Economic Note addresses these questions.

Should the government pre-fill your tax returns?

Presentation by Kevin Brookes, Public Policy Analyst at the MEI, at the Canada 2020 Tax and Competitiveness Summit in Ottawa.

5-minute read

Compétitivité des entreprises : une baisse d’impôt… s’impose!

The benefits of a tax cut for Canadian businesses and workers.

13-minute read

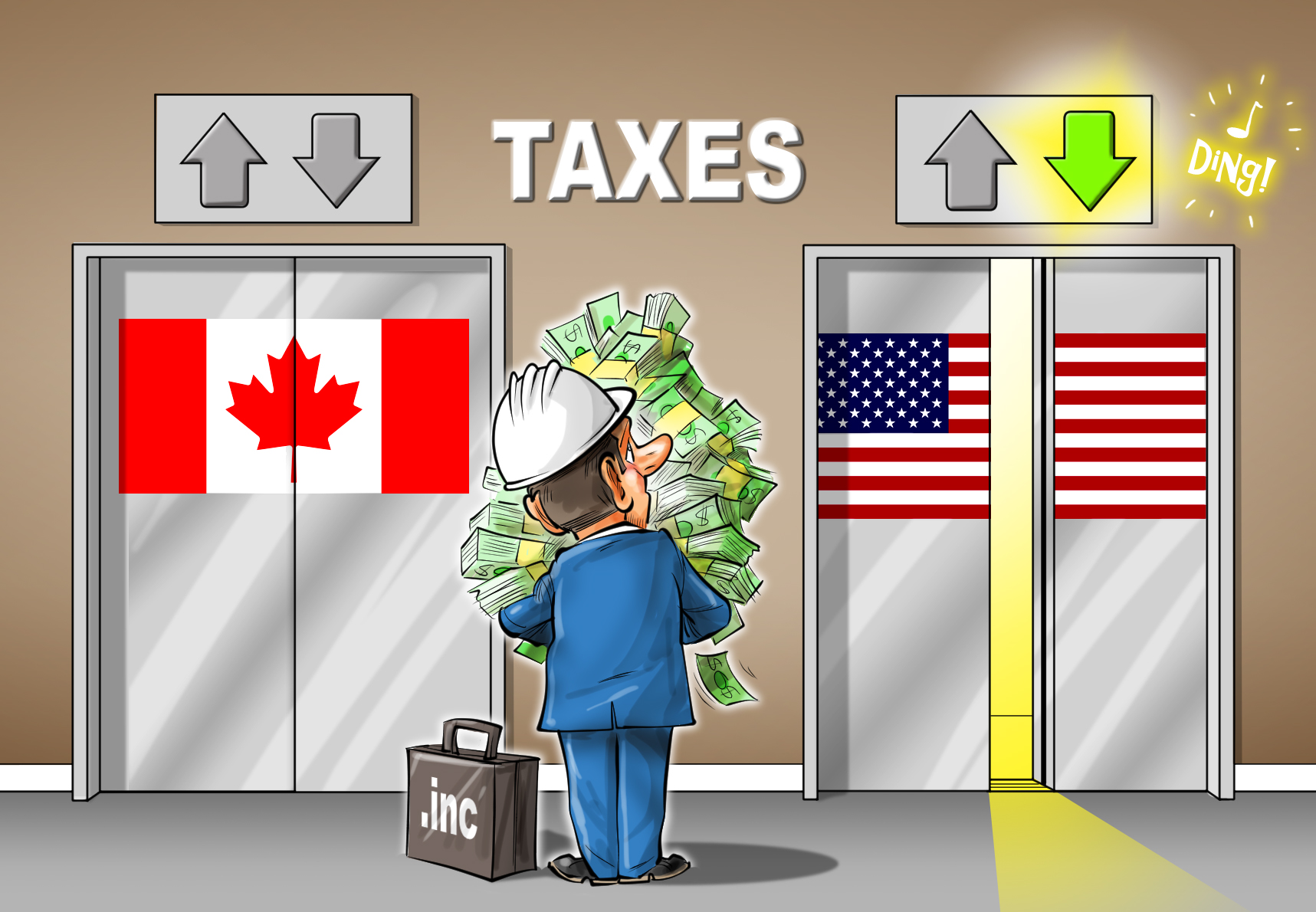

Restoring Canadian Competitiveness by Reducing Corporate Taxes

As the fall economic update approaches, the rumour is that Ottawa favours targeted measures to promote investment, rather than reducing the corporate income tax rate. This would be a mistake. The competitiveness of Canadian companies has been hurt by US tax cuts, and also by deregulation efforts south of the border. The federal government should use its update to lower corporate income taxes and restore the Canadian advantage; not acting would entail substantial costs not just for businesses, but for workers as well.

4-minute read

La priorité économique du gouvernement de la CAQ – Une occasion d’enrichir les Québécois

What should be the economic priority of the CAQ government?

4-minute read

Que retenez-vous du cadre financier des partis politiques? Des listes d’épicerie qui ne s’attaquent pas aux problèmes

What financial frameworks reveal.

4-minute read

More taxes, less innovation

The governments approach to entrepreneurship must be rethinked.

5-minute read

L’amour n’est pas plus fort que l’impôt

The governments approach to entrepreneurship must be rethinked.

11-minute read

Entrepreneurship and Fiscal Policy – How Taxes Affect Entrepreneurial Activity

Many try to divorce entrepreneurship from any fiscal questions, claiming that entrepreneurship is basically a passion, and that entrepreneurs start businesses out of love. Yet one of the fundamental aspects of economic analysis is that cost variations are a primary factor in accounting for human behaviour. This paper aims to provide a frank, open discussion of the fiscal measures that affect entrepreneurship.