7-minute read

Viewpoint – Economic Freedom and the Well-Being of Women around the World

International Women’s Day is an occasion to think about policies that are likely to improve the status of women around the world. Whereas the debate in rich countries has lately focused on gender parity for certain types of positions, in many countries women must still fight for access to health care, education, and the right to work. Numerous studies show that these objectives are more easily attained when women enjoy the advantages of economic freedom.

13-minute read

Green Energy Subsidies: Is Alberta Jumping on the Bandwagon?

In recent years, Canadian provinces have adopted various “green” energy policies that have had a discernable impact on their energy markets. Carbon levies and constraints on using certain energy sources to generate electricity are now commonplace, and their use seems to be spreading. Until recently, Alberta had avoided such policy tools. In addition, much electricity in Alberta is generated, transmitted, and sold by private market actors, and thus political interference in the market has mostly been avoided.

6-minute read

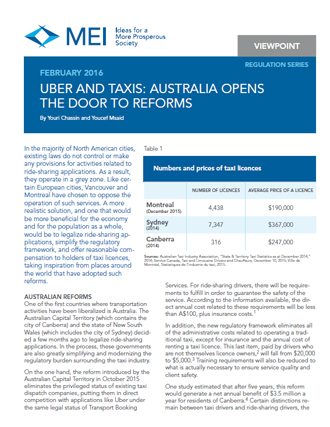

Viewpoint – Uber and Taxis: Australia Opens the Door to Reforms

In the majority of North American cities, existing laws do not control or make any provisions for activities related to ride-sharing applications. As a result, they operate in a grey zone. Like certain European cities, Vancouver and Montreal have chosen to oppose the operation of such services.

6-minute read

Viewpoint – Budgetary and Fiscal Performance: Quebec among the Most Improved Provinces

For several decades, Quebec has been one of the Canadian provinces in which public spending, the tax burden, and the debt level are the highest. One of the Quebec government’s main challenges is therefore to reverse these three trends in order to improve the dynamism of the province’s economy and to allow the population’s standard of living to rise. How does Quebec’s current government compare with the other provincial governments in achieving these goals?

13-minute read

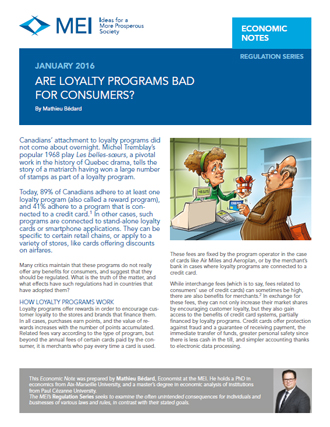

Are Loyalty Programs Bad for Consumers?

Today, 89% of Canadians adhere to at least one loyalty program (also called a reward program), and 41% adhere to a program that is connected to a credit card. In other cases, such programs are connected to stand-alone loyalty cards or smartphone applications. Many critics maintain that these programs do not really offer any benefits for consumers, and suggest that they should be regulated. What is the truth of the matter, and what effects have such regulations had in countries that have adopted them?

13-minute read

Enhance the Standing of the Teaching Profession by Firing Incompetent Teachers

According to Quebecers, the single most important factor in the success of students is the quality of the teaching staff. However, this profession is plagued by persistent problems: the poor university records of many education undergraduates, the abandonment of the profession by young teachers, discouragement and loss of motivation, etc. These problems can affect the quality of students’ learning, and are quite naturally a concern for parents.

12-minute read

Setting the Record Straight on Health Care Funding in Canada

Is the responsibility for financing health care services being increasingly entrusted to private actors? Is there more private sector funding of care here than in Europe, as some maintain? Contrary to what certain commentators declare, we are not witnessing the gradual privatization of health care funding in Canada. This Economic Note demonstrates that this is a myth, at least when it comes to medically required care, which forms the core of our health care system.

13-minute read

The Dilemma of Taxing Online Purchases

When Canadian consumers buy goods or services from retailers located outside their province, or outside Canada, it is very difficult to collect sales taxes on these transactions. Taxes on a certain portion of such purchases in other provinces and countries therefore go uncollected. The fact that these purchases are less expensive puts local online retailers, as well as brick-and-mortar retailers, at a disadvantage, as they are faced with a kind of unfair competition. Governments are also deprived, at first glance, of substantial revenues.

8-minute read

Viewpoint – Investing in Montreal: A Tax Burden That Ranks among Canada’s Highest

When a company seeks a place to invest, it needs to take into account the investment-related tax burden to be sure of choosing the most favourable location. Taxes that are too high in one city will lead companies to turn to other cities, bringing with them the new jobs and economic spillover that accompany their investments. Does the City of Montreal do everything it can to entice investors?

9-minute read

The Public Health Care Monopoly on Trial: The Legal Challenges Aiming to Change Canada’s Health Care Policies

Canadian patients still have very few options when it comes to health care services. The provision of care that is considered medically required remains largely monopolized by the public sector in each province. The role of private health insurance is limited solely to the coverage of services not insured by the public system. This Research Paper examines the legal challenges aiming to change Canada’s health care policies.