8-minute read

Taxing Sugar Will Not Halt the Rise in Obesity

Earlier this year, the Quebec government formed a committee whose stated goal was to propose a soda tax, for the purpose of reducing the prevalence of obesity. Yet there are numerous reasons to question the effectiveness of this measure. Indeed, when a tax modifies the price of a good, there is no guarantee that the replacement product will be better for one’s health than the taxed product.

8-minute read

The Minimum Wage: Ontario Was Right to Cancel the Hike to $15

Many politicians and interest groups advocate a rapid increase in the minimum wage in the name of social justice. Yet this ignores the results of past experiments. Ontario’s new Minister of Labour, Laurie Scott, pushed back by cancelling the increase to $15 planned for January 2019, and by stating that the minimum wage should be determined “by economics, not politics.” Subsequent increases will be set based on the annual change in the cost of living. This is a reasonable compromise, which will avoid further harming workers at the bottom of the ladder, and more specifically the young.

11-minute read

The Miracle of Supermarkets – The Perspective of the Austrian School of Economics

Although we take supermarkets for granted, our access to such a quantity and variety of food products on demand and at any time of year is absolutely remarkable. This “miracle” is all the more impressive given that it is the result of spontaneous and voluntary collaboration between millions of people, most of whom will never meet. This paper will examine the historical evolution and the current operation of supermarkets and the numerous intermediaries that supply them, using the analytical framework of the Austrian School of Economics.

10-minute read

The First Entrepreneurs – Natural Resource Development and First Nations

The media often convey the impression that First Nations wish to earn a living from traditional activities alone and have little interest in the development of their communities. Yet while some oppose mining and forestry or the building of energy infrastructure, others favour such development and wish to take advantage of the resulting wealth and jobs. This paper focuses on cases where First Nations decided to become involved in the development of resources on their territory, and on the benefits they derived from this involvement.

14-minute read

What Are the Benefits of Economic Freedom?

A useful and intuitive definition of “economic freedom” is the freedom (absence of coercion) to buy from, or sell to, a willing counterparty. A society based on economic freedom is a free-market society. But is economic freedom economically beneficial? Is it all about money? Is it moral? Aren’t there many exceptions where government intervention is warranted? This Economic Note addresses these questions.

13-minute read

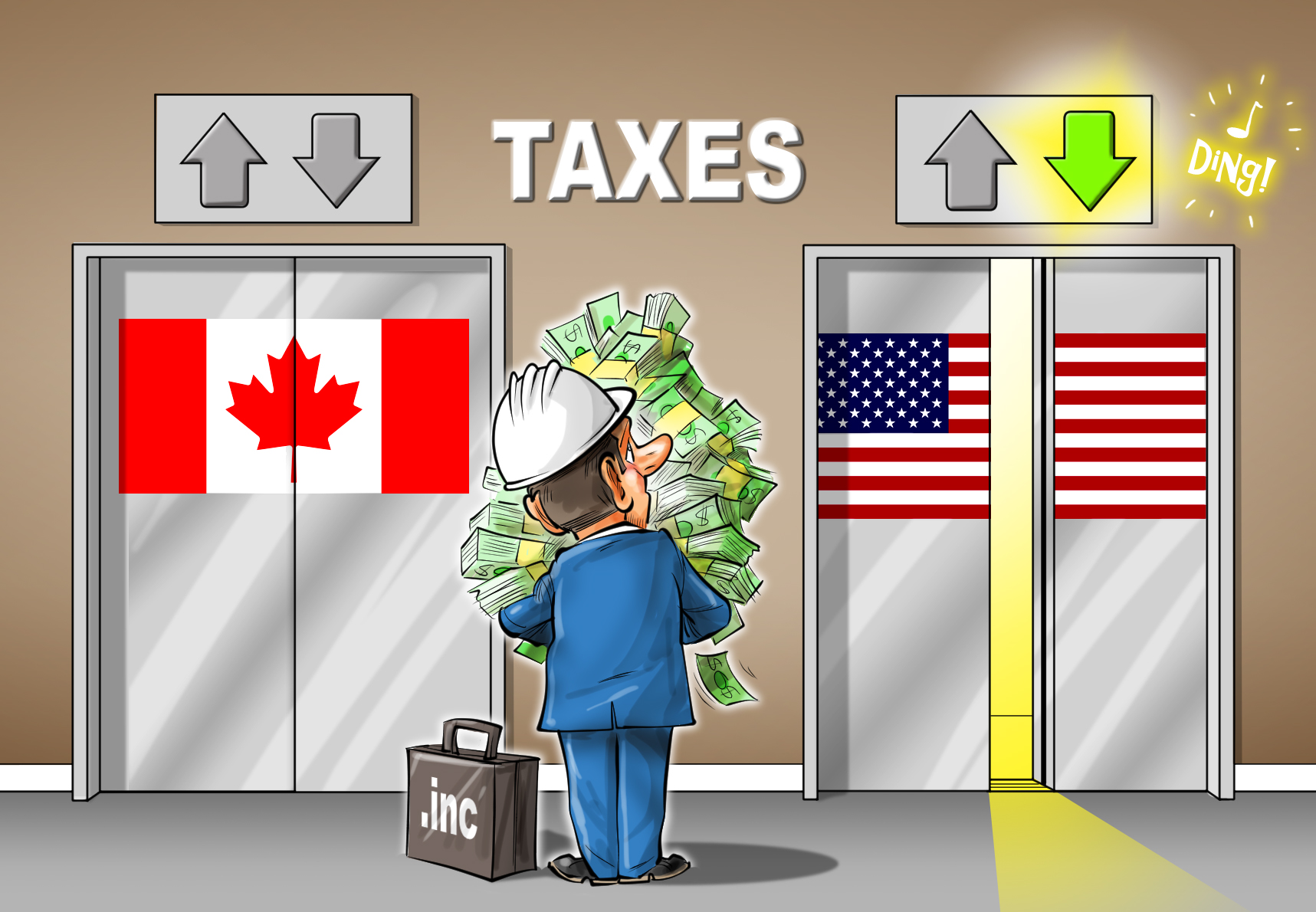

Restoring Canadian Competitiveness by Reducing Corporate Taxes

As the fall economic update approaches, the rumour is that Ottawa favours targeted measures to promote investment, rather than reducing the corporate income tax rate. This would be a mistake. The competitiveness of Canadian companies has been hurt by US tax cuts, and also by deregulation efforts south of the border. The federal government should use its update to lower corporate income taxes and restore the Canadian advantage; not acting would entail substantial costs not just for businesses, but for workers as well.

1-minute read

Twenty Years of Promoting Better Public Policies

This little booklet, published in the context of the MEI’s 20th anniversary celebration, presents a few highlights from our twenty years of activity. We hope that this brief retrospective will bring back fond memories to those who have known us for a long time, all while giving others a sense of the path we’ve travelled, our rich intellectual history, and our growth.

14-minute read

Energy Projects: Boosting Investment by Reducing Uncertainty

In recent years, numerous national energy projects have been cancelled or substantially delayed in Canada due to the ineffectiveness of the governmental approval process. This situation is alarming, given the contribution of the energy sector to the Canadian economy, but also our loss of competitiveness relative to our main trading partner. Indeed, the United States has put in place a series of reforms aimed at reducing the regulatory burden for businesses, while here, we are heading in the opposite direction.

11-minute read

How Innovation Benefits Forests

The accumulation of knowledge and technological change have led to a significant shift in forestry practices. As a result, forestry is now a sustainable activity supporting the economy in many parts of Canada. Despite this reality, various popular myths lead people to believe that wood harvests need to be reduced to ensure forest survival. On the contrary, the potential of Canadian forests is in fact underutilized, presenting opportunities for hundreds of forest-dependent towns and regions across the country.

11-minute read

Entrepreneurship and Fiscal Policy – How Taxes Affect Entrepreneurial Activity

Many try to divorce entrepreneurship from any fiscal questions, claiming that entrepreneurship is basically a passion, and that entrepreneurs start businesses out of love. Yet one of the fundamental aspects of economic analysis is that cost variations are a primary factor in accounting for human behaviour. This paper aims to provide a frank, open discussion of the fiscal measures that affect entrepreneurship.